What Are Accruals? How Accrual Accounting Works, With Examples

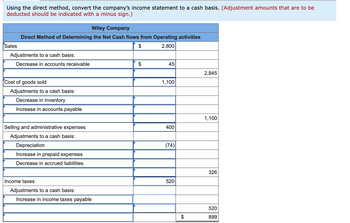

Understanding the accounting principles behind accrued expenses ensures correct financial reporting. These principles information how and after we acknowledge bills, making a consistent and transparent view of a company’s monetary health. Adjustments in accrued expenses immediately impact your cash circulate projections and your actual cash readily available. For example, a significant increase in accrued bills typically means a bigger cash outflow on the horizon.

Understanding Accruals

- Even though the bill hasn’t arrived yet, the company should still record the expense in December’s books to precisely mirror the interval when the service occurred.

- This not only saves priceless time but in addition minimizes the risk of guide errors, leading to extra accurate financial reporting.

- Accruing expenses like wages payable and utilities ensures a extra correct illustration of your company’s financial performance throughout a selected interval.

By leveraging expertise, companies can cut back errors, improve efficiency, and guarantee compliance. Get prompt entry to video classes taught by skilled investment bankers. Study monetary statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Pair accrual knowledge with BI instruments for visualizations, uncovering developments like seasonal accruals.

An excellent expense is previous due—like that utility bill sitting on your desk. It’s an expense you’ve incurred, and the payment deadline has already whooshed by. Assume of it as a financial “oops.” You can study extra about excellent bills and the way they impact your monetary statements. An accrued expense, on the other hand, is an expense you’ve incurred however isn’t due but.

Understanding Reversing Entries

You’ll have the flexibility to anticipate potential cash circulate issues and proactively regulate your spending. Automating expense monitoring can significantly simplify managing accrued expenses. Software like Accruer can automate recording and allocating expenses, minimizing handbook information entry and lowering the chance of errors.

You should accrue expenses when you observe the accrual basis, which is probably the most accurate approach to accounting. Accounts payable are short-term debts for items or services for which invoices have been received, but payment is yet to be made. Many accounting software program methods auto-generate reversing entries when prompted. During a project I managed years ago, switching to accrual revealed hidden liabilities that money tracking missed, preventing a nasty shock at tax time. Accrual, then again, paints a fuller picture, particularly when coping with credit score gross sales or prepaid bills. Entities following US GAAP reporting necessities should use the accrual foundation of accounting, which is why it’s required for compliance with US GAAP.

It can’t keep up with stuff like stock or offers where people pay you later. As Soon As, in a faculty membership, mixing up prices made a project look way more profitable than it was, complicated everybody till accrual fixed it. If you purchase paint for a faculty art project, you document that cost whenever you promote the art work, not when you paid for the paint. The income recognition precept means you write down money as quickly as you earn it, like if you end a job, even if the cash comes later. You can think of accrual as a time traveler for transactions—bringing future obligations into the present for better decision-making.

Accrual accounting is the commonly accepted accounting principles (GAAP) preferred methodology, providing a more accurate monetary picture than cash basis accounting. Accruals ensure expenses are acknowledged within the period they relate to, not simply once they’re paid. This is essential for correct financial reporting and matching ideas, offering a extra complete view of your corporation’s monetary efficiency. For example, if you obtain a utility invoice in January for providers utilized in December, accrual accounting dictates that you just report the expense in December, despite the actual fact that you paid it in January. This aligns the expense with the interval it belongs to, leading to more correct and insightful monetary statements. For more on accrual accounting and year-end accruals, see this useful guide from Princeton University.

FinOptimal offers managed accounting providers and software options designed to simplify these complexities. These is usually a bit trickier to trace because they do not comply with a daily schedule. For example, if your small business incurs authorized expenses, invoices won’t arrive instantly. The estimated price of authorized services received however not but billed represents an accrued liability. Similarly, surprising repairs to equipment or facilities can create an accrued liability if the bill isn’t obtained immediately after the service is carried out.

If you use cash accounting, you won’t report accrued expenses as a outcome of you’ll solely record the expenses once the worker is paid in July. But with accrual, the expenses show up in your income assertion in June as your worker purchases the provides. Accrued expenses are a cornerstone of accrual accounting, making certain expenses are recorded within the interval they happen, not when money changes arms.

Accrual accounting paints a clearer picture by matching revenues with the bills incurred to generate them, even if the money circulate hasn’t occurred but. This implies that corporations need to account for uncollected revenues and unpaid expenses, like accounts payable, to precisely mirror their financial situation. Even for small companies, tracking accrued expenses is essential for a quantity of causes. Knowing your future payment obligations allows you to plan and keep away from surprises. Lastly https://www.simple-accounting.org/, correct accrual accounting is usually required for compliance with accounting requirements, which is important should you’re looking for loans or investments.